The Building Blocks

to scale your Business

Neokred is the digital infrastructure layer that helps modern businesses scale by streamlining

profiling, payments, and privacy.

.svg)

.svg)

.svg)

.svg)

> 100 Million

Transactions Processed

> 4 Crore

Profiles Verified

$49 billion

Transaction Volume Processed

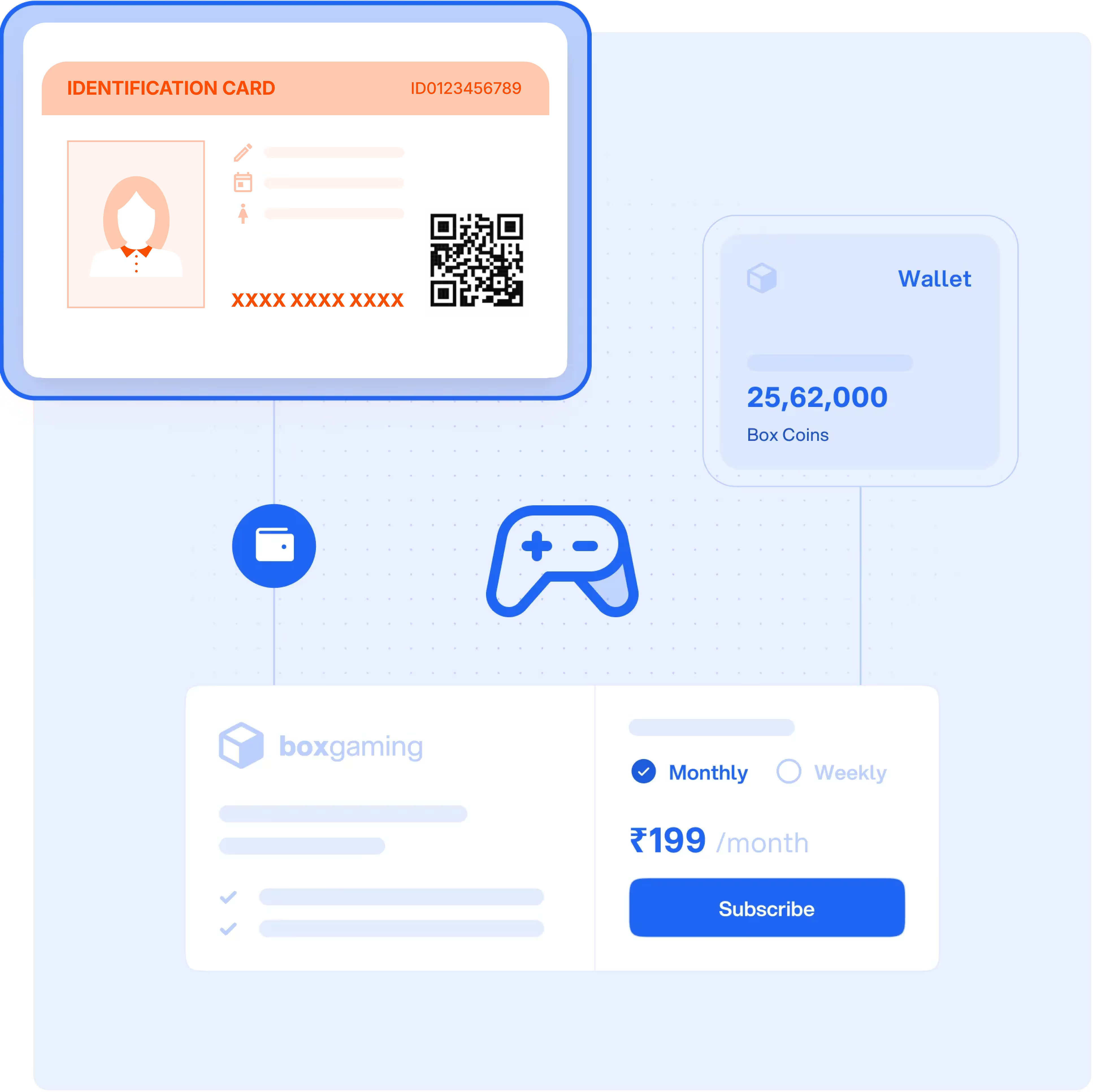

Smarter Profiling through Digital Identity Verification

Digital Identity Verification

Build a 360* user

profile

profile

Reduce onboarding time

Ensure regulatory compliance

Live Fraud Monitoring

Detects anomalies through device Intellgience

Fraud detection without delaying good users

Real-time risk scores and signals

Scalable Payment infrastructure for businesses

Online Checkout SDK

Accept payments across

Cards

Net Banking

UPI

Wallets

Intelligent payment routing

Simple

integration

Uniq Soundbox

Instant, voice-based transaction alerts

Secure and Scalable.

Proudly Made In India

Proudly Made In India

Backed by MQTT

& TMS

& TMS

NPCI Certified UPI Switch

Affordable fees

Ultra-low

latency

Proactive

Support

Trust them with

round-the-clock support

Round-the-clock support from team Neokred has been one of the building blocks of our long association with the brand.

Murugesh

Head - Bangalore Branch, Equitas Bank

Products integrate

seamlessly into the system

The best thing about Neokred is the ease with which the products have been integrated into our system to elevate our day-to-day activities.

Aatul Ahluwalia

Head of Strategy, Coinswitch

Great products;

competitive pricing

competitive pricing

Competitive pricing and top-notch quality have been the reasons we chose Neokred over other brands.

Mrityunjay Hiremath

CEO, LogiPe

We Have Something in Store for All Businesses

Effortless User Onboarding

Simplify onboarding of new customers with real-time document verification and fraud detection, creating a secure shopping environment.

Enhance customer profiles with mobile data, reducing onboarding time and gaining better customer understanding.

Seamless Payments

Accept payments through various channels like cards, net banking, UPI, and wallets, providing a smooth checkout experience.

Manage refunds, reward disbursements, and vendor payments efficiently with multiple disbursement options.

Building Customer Loyalty

Offer personalized financial services like spend analysis, bill reminders, and budgeting to increase customer loyalty.

Streamlined User Onboarding

Ensure fast and secure onboarding of new users, critical for compliance and fraud prevention in financial services.

Leverage mobile data to build comprehensive user profiles and meet regulatory compliance requirements.

Frictionless Payments

Facilitate fast and secure transactions with ultra-low latency and cost-effective processing fees.

Enable real-time reconciliation and fund settlement, providing detailed analytics for financial tracking.

Enhancing User Engagement

Manage user consent for data processing, ensuring compliance with data protection regulations.

Provide advanced analytics and tracking for financial data, fostering user engagement and trust.

Efficient User Onboarding

Streamline the onboarding process with real-time verification and robust fraud detection mechanisms.

Ensure accurate user profiling and compliance with KYC regulations.

Frictionless Payments

Support various use cases such as instant refunds, credit card repayments, and insurance disbursements.

Offer seamless fund reconciliation and settlement with detailed transaction analytics.

Building User Trust

Manage the entire consent lifecycle for data processing, ensuring compliance and building user trust.

Utilize advanced analytics to offer personalized financial insights and services.

Secure Onboarding

Ensure secure and efficient guest verification processes, enhancing trust and safety.

Build detailed guest profiles to tailor services and offers.

Seamless Payments

Facilitate a smooth booking and payment experience across various channels, improving the guest experience.

Efficiently manage payments for vendors, staff, and refunds with multiple disbursement options.

Enhancing Guest Satisfaction

Offer personalized services like budget recommendations and spend analysis to improve guest satisfaction.

Ensure data protection compliance, boosting guest trust and loyalty.

Fast and Efficient User Onboarding

Securely and efficiently verify student and staff identities.

Create comprehensive profiles to personalize learning experiences and administrative processes.

Simplified Payments

Simplify fee payments, donations, and other transactions through multiple payment channels.

Manage scholarship disbursements, staff payments, and vendor transactions seamlessly.

Empowering Users

Provide students and staff with tools for financial management, like budgeting and spend analysis.

Manage consent for data use, ensuring compliance with education data protection standards.

Secure Onboarding

Verify patient and staff identities securely, complying with healthcare regulations.

Build detailed patient profiles to improve personalized care and services.

Frictionless Payments

Facilitate smooth payment processes for medical bills, appointments, and services through multiple channels.

Efficiently manage payments for healthcare providers, insurance claims, and vendor transactions.

Improved Patient Engagement

Offer patients financial tools like spend analysis and bill reminders to improve their financial health management.

Ensure compliance with healthcare data protection regulations, maintaining patient trust and loyalty.

Effortless User Onboarding

Securely verify tenant and buyer identities, fostering trust in the transaction process.

Build detailed profiles to personalize property recommendations and services.

Frictionless Payments

Enable smooth payments for rent, property purchases, and service fees across various channels.

Manage payouts for property agents, contractors, and vendors efficiently.

Building Long-Term Relationships

Offer financial tools for budgeting, spend analysis, and property maintenance tracking.

Ensure compliance with real estate data protection regulations through consent management.

Streamlined User Onboarding

Securely onboard users for streaming services, creating a safe and compliant environment.

Build comprehensive user profiles to tailor content recommendations and services.

Frictionless Subscriptions

Facilitate seamless subscription payments across multiple channels, enhancing the user experience.

Manage disbursements for content creators, advertisers, and service providers efficiently.

Boosting User Engagement

Provide users with tools for managing subscriptions, tracking expenses, and receiving personalized content recommendations.

Ensure compliance with data protection regulations, fostering user trust and loyalty.

Onboarding Verified Users

Securely verify identities of new users to comply with regulatory requirements and prevent fraud in cryptocurrency transactions.

Frictionless Payments

Facilitate seamless cryptocurrency transactions across multiple channels, ensuring fast and secure payments for buying and selling digital assets.

Manage payouts to crypto traders, miners, and service providers efficiently, supporting various payout destinations.

Retaining Users

Provide advanced analytics and tracking for cryptocurrency portfolios, offering users insights into their balances, transaction history, and market trends.

Ensure compliance with data protection regulations, building trust and loyalty among users by managing consent for data processing securely.

Onboarding Verified Users

Quickly and securely onboard gamers and developers, ensuring compliance with gaming regulations and preventing fraudulent activities.

Seamless Payments

Enable seamless in-game purchases, subscription payments, and withdrawals across multiple payment channels, providing a smooth and enjoyable gaming experience.

Efficiently manage disbursements for game developers, tournament winners, and virtual goods sellers, supporting various disbursement methods.

Retaining Users

Offer tools for tracking in-game expenses, managing virtual assets, and receiving personalized gaming offers and rewards.